421-a Tax Exemption

A failed experiment in incentivizing affordable housing

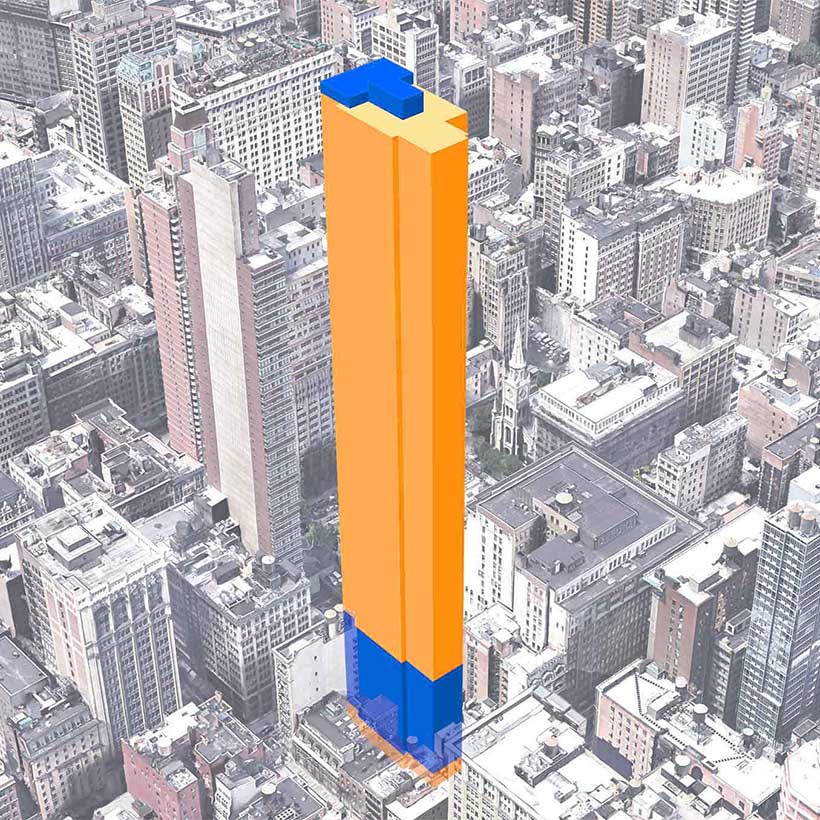

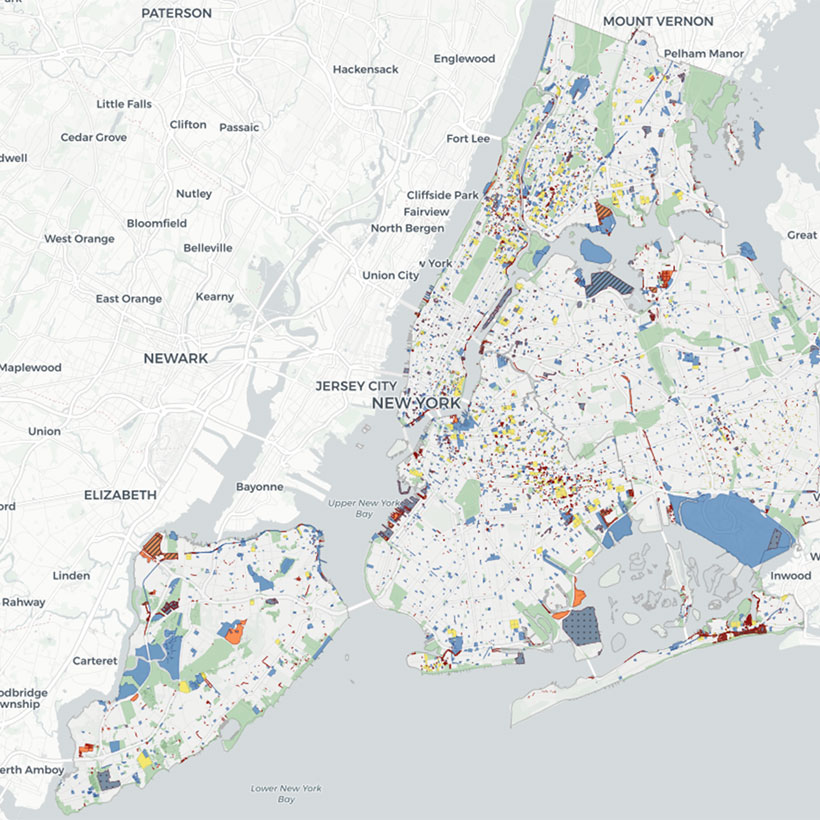

In total, the city forfeited more than $1.1 billion in tax revenue in 2014 alone through the 421-a program, 60% of which subsidized buildings in Manhattan.

[Interactive map has been archived as of March 2025.]

What is 421-a?

Section 421-a of the New York State Real Property Tax Law (or “421a”) is a government program that grants tax exemptions for new residential construction in New York City.

The dual purpose of the program is to:

- increase production of total housing units, including market-rate units; and

- increase production of affordable housing units for low- and moderate-income New Yorkers.

The tax break exempts the increase in property tax that results from new construction for up to 25 years, depending on the project. See detailed requirements on NYC.gov.

History of 421-a

The program started in 1971, as a way to combat a weak real estate market, marked by declining property values and a downturn in the city’s population.

As New York’s real estate market recovered in the 1980s, the program was amended to require that new construction in relatively prosperous neighborhoods in Manhattan either set aside affordable housing units or finance the construction of affordable units off-site.

- Rationalize 421-a’s cost-benefit equation either by strengthening the affordability requirements or by decreasing the financial incentives;

- Redraw the lines of the GEA to reflect actual market conditions, based on data and statistics, rather than politics; and

- Dramatically increase the program’s public transparency and use this data to monitor the program’s successes and failures.

Follow MAS:

MAS members and partners are crucial to everything we do. Please consider contributing to MAS and joining our community of advocates.

Support UsContact a staff member about this initiative. planning@mas.org >